Intense competition in e-commerce sector

An industry source familiar with Alibaba and the e-commerce industry says the company is in talks with Central Group and Charoen Pokphand (CP) to sell its stake in Lazada Thailand, following intensifying competition in the local market.

“There are several rumours Alibaba would like to sell Lazada as the e-marketplace segment faces intense competition from Shopee and fast-rising TikTok,” said the source.

CP is a prospective buyer as CP and Alibaba have a relationship through Alibaba’s Ant Group, which owns shares in CP subsidiary Ascend Money.

LazMall shares a common position to Central Group as a premium brand name retail shop.

Another source who requested anonymity questioned whether the rumour is true as Central posted a loss of 20 billion baht from its joint venture JD Central with Chinese internet giant JD.com. The venture shuttered operations last year.

A Lazada spokesperson said Wednesday night, “Lazada Group is not considering any divestment of our business in Thailand and is not in discussion with any investors on this topic. Any rumours stating otherwise are untrue.”

KrASIA digital media firm reported last month Southeast Asian e-commerce platform Lazada received US$230 million in capital from parent Alibaba, according to regulatory filings accessed by Alternatives.pe, a provider of private market data in Southeast Asia and Australia.

According to KrASIA, this marks Alibaba’s first capital injection into Lazada this year. Alibaba has invested roughly $7.7 billion in Lazada since 2016, when it acquired a controlling stake in the company.

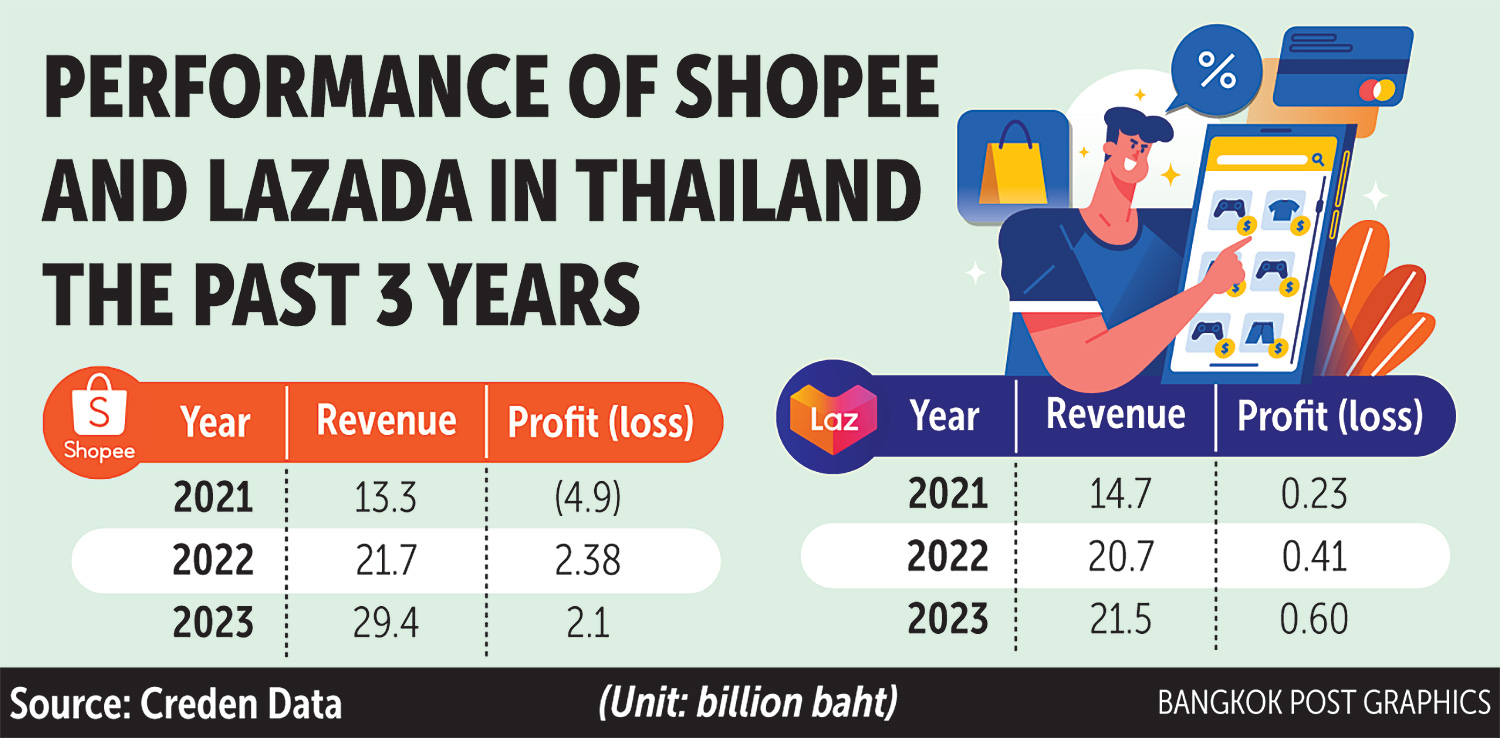

Business data platform Creden Data reported Lazada (Thailand) posted revenue of 21.5 billion baht last year, up 3.8% year-on-year, while profit was 604 million baht, a gain of 46%. This was the third consecutive year the company registered a profit.

Lazada Thailand reached profitability in 2021, tallying 226 million baht after operating for a decade and posting a loss of 3.9 billion baht in 2020.

Shopee (Thailand), the e-commerce arm of Sea Group, posted revenue of 29.4 billion baht last year, up 35% year-on-year, with profit of 2.1 billion, down by 9%. This was the second consecutive year for Shopee Thailand to post a profit.

In 2022, Shopee Thailand recorded a profit of 2.3 billion baht, compared with a loss of 4.9 billion baht in 2021.

Lazada logistics arm Lazada Express posted revenue of 16.7 billion baht in 2023 and profit of 2.9 billion, while SPX Express (Thailand) recorded revenue of 16.6 billion baht and profit of 34 million.

According to Creden Data, TikTok registered its e-commerce business TikTok Shop (Thailand) in the country in November 2023.

In 2023, TikTok Shop (Thailand) reported a loss of 290,000 baht and assets of 5 million baht, with registered capital of 50 million baht.

The source familiar with the e-commerce industry said both Shopee and Lazada have additional revenues and cost from managing delivery companies, marketing services and regional cost that might not be fully reflected in the performance of local entities.

However, Shopee Thailand has a higher profit than Lazada Thailand, as the former restructured its operations in early 2023. Lazada has focused on cost reduction this year, said the source.

“Both companies are unhappy with their financial performance and are looking to increase revenue,” said the source.

“Shopee already announced a further commission fee increase, effective from July.”